Trust Your Advisor

We are dedicated to providing portfolio management services.

Freedom Capital Management July Market Update (Click for Full Article)

Note since the beginning of the year the S&P 500 has been in a channel marked by the two black horizontal lines that run across the chart. On June 2nd the S&P 500 broke above the top of the channel, which would be considered resistance, on high volume that was 216% above average volume, which is marked on the chart. The high volume on the breakout demonstrates that investors and traders were aware of the channel being broken and wanted to add to, or initiate positions.

Freedom Capital Management June Market Update (Click for Full Article)

June 11, 2023 One would think economic news would slow down after getting past last week’s debt limit deal that cut borrowing by $1.5 trillion. But this week we will be hearing more important economic numbers beginning on Tuesday. This week’s reports may have an impact on the markets. Tuesday 6/13: Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Wednesday 6/14 The Producer Price Index...

We put our clients’ interest first.

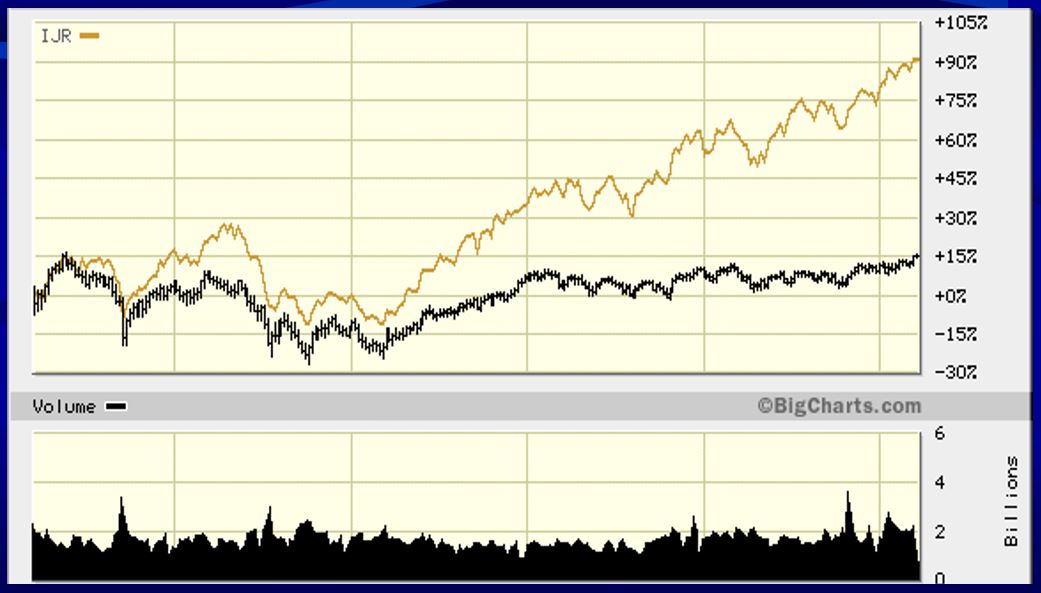

Our Relative Strength Portfolio Strategy is positioned to be in the top performing areas of the market.

We adjust holdings when the leadership changes.

- Top Down Market Approach

- Relative Strength Portfolio Construction

- Definable Investment Process

- Client Focused

- Client Involvement

Stocks and Options

ETFs and Mutual Funds

Group Retirement and Savings

IRA, 401K and Rollovers

Bonds

Simplified Employee Pension Plans

Annuities

U.S. Treasuries Securities

Qualified Retirement Plans

Portfolio Growth Starts Here.

(415) 236-5364

Advisory services offered through Freedom Capital Management, Inc.

Custodial services at Interactive Brokers, LLC.

Member FINRA / SIPC Freedom Capital Privacy Policy

The information included herein was obtained from sources which we believe reliable, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation by us for the purchase or sales of any securities or other financial instruments. There is no assurance that the Relative Strength Portfolio Strategy or any investment strategy will be successful.