Trust Your Advisor

We are dedicated to providing portfolio management services.

Freedom Capital Management April Market Update (Click for Full Article)

Year to date the S&P 500 index which is tracked by the symbol “SPY” is near the middle of a channel since January 1st. As indicated on the chart below, the blue line is the 200-day moving average and the red line is the 50-day moving average. Between January 24th and March 21st, the SPY traded most of this time below the 200-day moving average and the 50-day moving average. Also, as of March 14th the 50-day moving average has crossed below the 200-day moving average, another sign of weakness.

Freedom Capital Management March Market Update (Click for Full Article)

Since the beginning of this year the S&P 500 has declined almost 15%. A bear market is when a market experiences prolonged price declines when securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment. Very few people are saying we are in a bear market but with the Russian Invasion and rising inflation we are not far off.

We put our clients’ interest first.

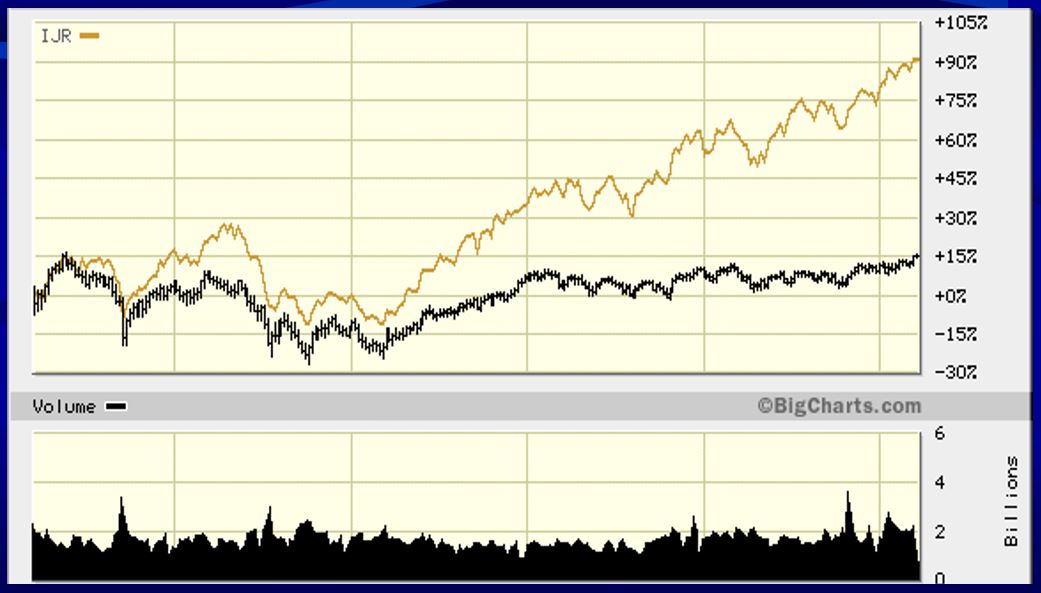

Our Relative Strength Portfolio Strategy is positioned to be in the top performing areas of the market.

We adjust holdings when the leadership changes.

- Top Down Market Approach

- Relative Strength Portfolio Construction

- Definable Investment Process

- Client Focused

- Client Involvement

Stocks and Options

ETFs and Mutual Funds

Group Retirement and Savings

IRA, 401K and Rollovers

Bonds

Simplified Employee Pension Plans

Annuities

U.S. Treasuries Securities

Qualified Retirement Plans

Portfolio Growth Starts Here.

(415) 236-5364

guy@freedomcapitalmanagement.com

Advisory services offered through Freedom Capital Management, Inc.

Custodial services at Interactive Brokers, LLC.

Member FINRA / SIPC Freedom Capital Privacy Policy

The information included herein was obtained from sources which we believe reliable, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation by us for the purchase or sales of any securities or other financial instruments. There is no assurance that the Relative Strength Portfolio Strategy or any investment strategy will be successful.