by Guy Woolley | Aug 7, 2022 | Finance

August 7, 2022

Zig Zag and Cycles

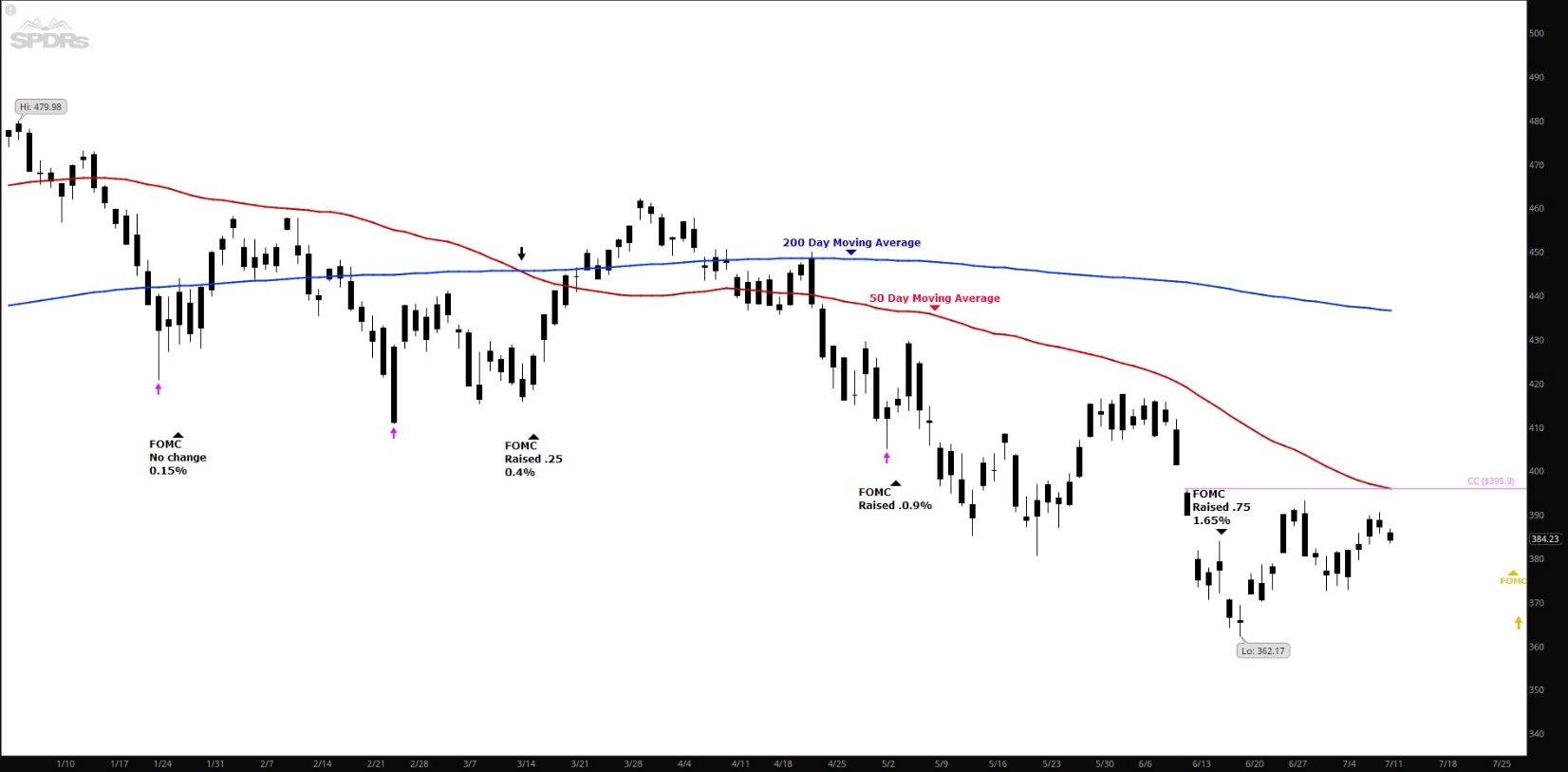

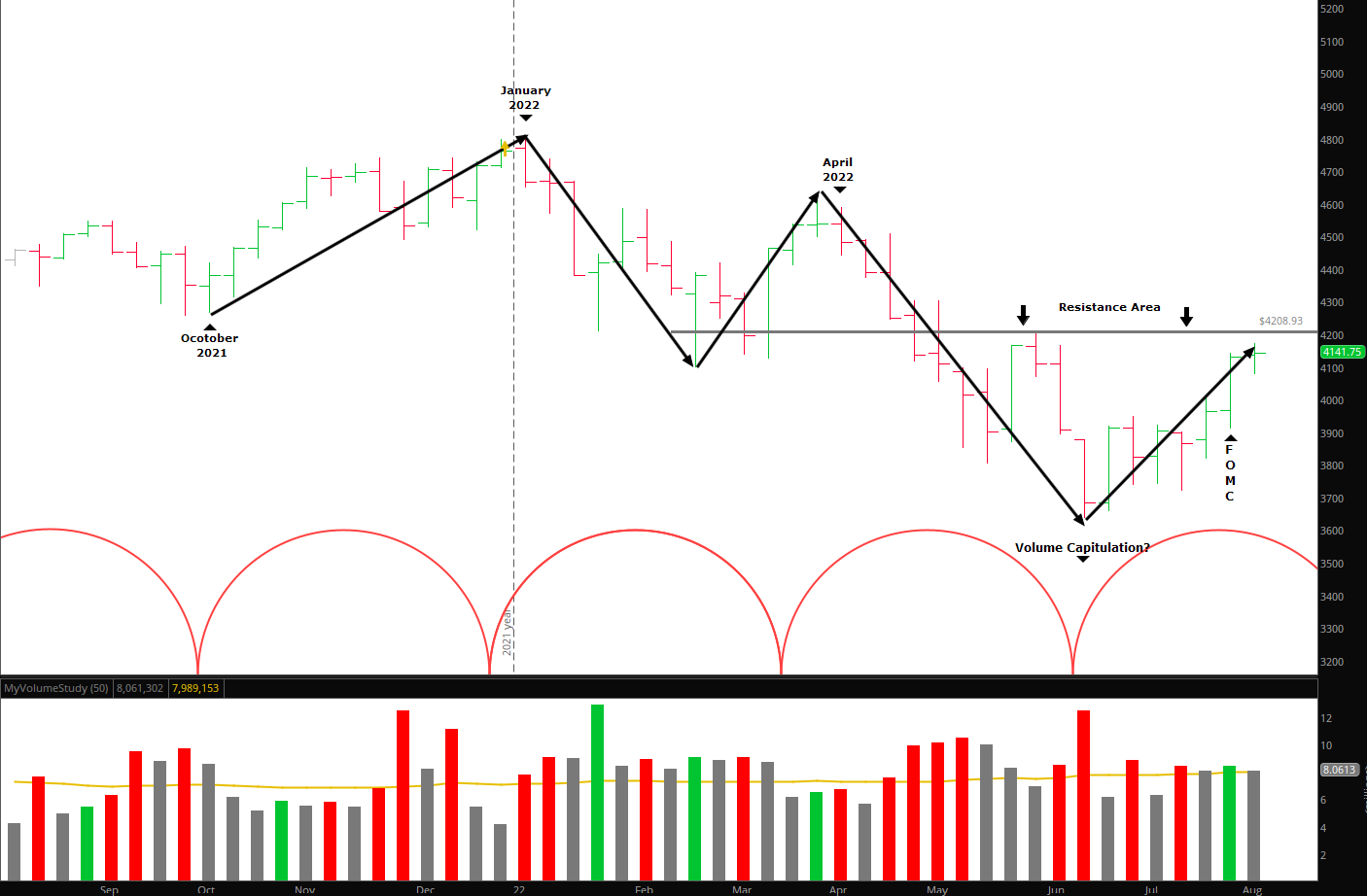

The chart below is a weekly chart of the S&P 500 Index ETF, “SPY.” Since last October the market has been in a zig-zag pattern indicated by the black line over the weekly price bars. From Investopedia: “The Zig Zag indicator does not predict future trends; it helps to identify potential support and resistance zones between plotted swing highs and swing lows”. Unfortunately, the “SPY” has made lower swing lows since October.

Under the price chart is a red 13-Week Cycle Indicator. Cycle lengths can change very quickly, and I rarely look at cycles, but the recent 13-Week Cycle Indicator seems to closely indicate the highs and lows and a change of direction within the Zig Zag pattern. I find this correlation interesting.

I wrote about market capitulation in a past newsletter and we may have had a capitulation that happened on the high red volume bar that is indicated on the chart. For the last 3-weeks the S&P 500 has been trending up, and the market has continued to rise since the FOMC meeting on July 27th. For the market to continue to show any meaningful strength it must break through the resistance line indicated on the chart. If it can break higher it would be reassuring if volume increased too.

The VIX Index closed Friday at 21.15 and has been dropping for seven weeks. On July 1st it closed at 26.70. A falling VIX is normally bullish for the markets. I prefer the VIX below 20 and a VIX below 15 is more bullish.

Percent of stocks above their 50-day and 200-day moving average: On 7/1 only 22% of stocks were above their 50-day moving average, today 72% are above their 50-day moving average. Last month 23% of the stocks were above their 200-day moving average, today 35% are above their 200-day moving average. When the 50-day is rising and above the 200-day moving average, that is bullish. When 60% of stocks are above their 200-day moving average that is very bullish. This indicator confirms the market’s recent rise.

Federal Reserve: On July 27th the Federal Reserve approved a ¾ percentage point increase in the primary credit rate to 2.5 percent. The next FOMC meeting announcement will be Wednesday, September 21st.

Employment Rate: Total nonfarm payroll employment rose by 528,000 in July, and the unemployment rate edged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported on August 5, 2022. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Both total nonfarm employment and the unemployment rate have returned to their February 2020 pre-pandemic levels

Inflation Rate: The annual inflation rate for the United States is 9.1% for the 12 months ended June 2022, the largest annual increase since November 1981 and after rising 8.6% previously, according to U.S. Labor Department data published July 13. The next inflation update is scheduled for release on August 10 at 8:30 a.m. ET. It will offer the rate of inflation over the 12 months ended July 2022.

The 10-year Treasury index yield: The 10-year rate today is at 2.84%. On July 1st it was at 2.88%.

To view past Market Newsletters, go to www.freedomcapitalmanagement.com. On the home page you will see recent newsletters and for older newsletters go to the blog page tab at the top of the home page.

In this month’s recap: Stocks surge on receding inflation and recession worries and better-than-expected second-quarter earnings.

Monthly Economic Update

Presented by Guy Woolley, August 2022

U.S. Markets

Stocks posted big numbers in July, erasing some of their first-half losses. Investor sentiment was lifted by receding inflation and recession worries and a better-than-expected start to the second quarter earnings season.

The Dow Jones Industrial Average gained 6.73 percent, while the Standard & Poor’s 500 Index rose 9.11 percent. The Nasdaq Composite led, picking up 12.35 percent.1

Hopeful Signs

Stocks have been under pressure all year from rising inflation and slowing economic growth. There weren’t many signs in July that suggested either inflation had cooled or that the economy was rebounding. Nevertheless, investors saw falling energy prices and persistent strength in the labor market as hopeful signs that any economic downturn may not be as severe as some expect.

Earnings Help Rally

Investor sentiment improved further as earnings season got underway in the back half of the month. This gathering optimism was not a result of exceptional earnings results. Rising enthusiasm was perhaps more attributable to the fact that earnings were not nearly as weak as many had feared. Companies painted a picture of a reasonably healthy consumer and businesses effectively navigating their inflation and supply chain challenges.

Big Week of Data

The month of July culminated in perhaps the most critical week of the summer for the market, with investors awaiting information on corporate earnings, a Fed meeting decision on interest rates, and the release of an initial estimate of the second quarter GDP.

Investors Impressed

Earnings came out of the gate a bit shaky as a big box retailer missed earnings and guided future earnings estimates lower. However, subsequent earnings reports from big technology companies impressed investors. Markets were further relieved by the Fed’s decision to hike rates by 75 basis points and Fed Chair Powell’s comment that the pace of future rate hikes may slow.

Investors shrugged off a negative second quarter gross domestic product report as positive earnings surprises drove stocks higher into the close of the month.

Sector Scorecard

All 11 sectors posted gains for the month, including Communications Services (+3.87 percent), Consumer Discretionary (+18.44 percent), Consumer Staples (+3.20 percent), Financials (+7.19 percent), Health Care (+3.24 percent), Industrials (+9.50 percent), Materials (+6.15 percent), Real Estate (+8.52 percent), Energy (+9.66 percent), Technology (+13.45 percent), and Utilities (+5.45 percent).2

What Investors May Be Talking About in August

Historically, August has been positive for stocks, with an average return of 0.7 percent for the month. August also has more positive monthly performances (55) than negative (39).3

But August is also known for unexpected national and world events that have moved the markets in unexpected ways. Events that have occurred in August include the Asian currency crisis in 1997, the Long-Term Capital Management collapse in 1998, the downgrade of U.S. debt in 2011, and China’s currency crisis in 2015.

During the month, the government will release a string of economic reports to give the Fed fresh insight into the economy for its late September meeting. After September, the Fed only has two scheduled meetings for the rest of 2022—one in early November and one in mid-December.

T I P O F T H E M O N T H

As you retire, look at the changes in your expenses. Will your mortgage soon be paid off? What business-related expenses will disappear, and what new expenses will emerge? This may matter greatly in your retirement strategy.

World Markets

Overseas markets rallied following the lead of the U.S. markets. The MSCI-EAFE Index gained 3.74 percent last month.4

Similar to U.S. markets, major European markets overcame growing recession fears and deepening energy woes. France picked up 8.87 percent, Italy rose 5.71 percent, Germany 5.48 percent, and the U.K. tacked on 3.54 percent.5

Pacific Rim markets were mostly higher, except for Hong Kong, which lost 7.79 percent. Australia gained 5.74 percent and Japan climbed 5.34 percent.6

Indicators

Gross Domestic Product: The economy shrank at an annualized rate of 0.9 percent in the second quarter as consumer spending moderated and businesses reduced inventories. GDP posted its second straight quarter of negative growth, meeting the technical definition of a recession. Unlike most recessions, however, the past two quarters have been marked by strong employer hiring.7

Employment: Non-farm payrolls increased by 372,000 in June, with the unemployment rate unchanged at 3.6 percent. Wages increased 5.1 percent year-over-year.8

Retail Sales: Retail sales rose 1.0 percent in June, beating consensus estimates.9

Industrial Production: Industrial production declined 0.2 percent in June, though it was higher by 6.1 percent in the second quarter.10

Housing: Housing starts slipped 2.0 percent as rising prices and mortgage rates weighed on buyer demand. It was the second consecutive month of declines.11

Existing home sales fell 5.4 percent, while the median sales price climbed 13.4 percent to another record high of $416,000.12

New home sales declined 8.1 percent in June, falling to levels not seen since April 2020. Year-over-year sales were down 17.4 percent.13

Consumer Price Index: Prices of consumer goods and services climbed 1.3 percent in June. The 12-month increase was 9.1 percent, a 40+ year high. Core inflation (excluding volatile food and energy prices) remained elevated as well, rising 0.7 percent from May’s levels and 5.9 percent from a year ago.14

Durable Goods Orders: Orders for products designed to last three years or more rose 1.9 percent. When excluding defense spending, durable goods orders were up a more modest 0.4 percent.15

Q U O T E O F T H E M O N T H

“The most valuable player is the one who makes the most players valuable.”

PEYTON MANIING

The Fed

Fed officials agreed to a 0.75 percentage point hike in the federal funds rate, acknowledging that the economy has slowed since the Federal Open Market Committee in June.16

In a post-meeting press conference Fed Chair Powell said that future rate hikes would be made on a meeting-by-meeting basis and that it may become appropriate to slow the pace of future interest rate hikes.16

| MARKET INDEX |

Y-T-D CHANGE |

July 2022 |

| DJIA |

-9.61% |

6.73% |

| NASDAQ |

-20.80% |

12.35% |

| S&P 500 |

-13.34% |

9.11% |

|

|

|

| BOND YIELD |

Y-T-D |

July 2022 |

| 10 YR TREASURY |

1.13% |

2.64% |

Sources: Yahoo Finance, July 31, 2022.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

T H E M O N T H L Y R I D D L E

Michael introduces Levi to his friends, stating that Levi’s father is also the son of Michael’s father. But Michael is an only child. So how are Michael and Levi related?

LAST MONTH’S RIDDLE: Tim says he heard that you can find $200 stuffed between pages 147 and 148 of a romance novel at the library. What detail convinces you that he is wrong?

ANSWER: The pagination. Page 147 is a right-hand page, page 148 would be the left-hand page printed on its reverse. So nothing could be kept between these pages.

Guy Woolley may be reached at 415-236-5364 or [email protected]

www.freedomcapitalmanagement.com

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

«RepresentativeEmailDisclosure»

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The FTSEurofirst 300 Index comprises the 300 largest companies ranked by market capitalization in the FTSE Developed Europe Index. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. Established in January 1980, the All Ordinaries is the oldest index of shares in Australia. It is made up of the share prices for 500 of the largest companies listed on the Australian Securities Exchange. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The FTSE TWSE Taiwan 50 Index is a capitalization-weighted index of stocks comprising 50 companies listed on the Taiwan Stock Exchange developed by Taiwan Stock Exchange in collaboration with FTSE. The MSCI World Index is a free-float weighted equity index that includes developed world markets and does not include emerging markets. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The U.S. Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting, or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1. WSJ.com, July 31, 2022

2. Sector.SPDR.com, July 31, 2022

3. Yardeni Research, Inc., 2022

4. MSCI.com, July 31, 2022

5. MSCI.com, July 31, 2022

6. MSCI.com, July 31, 2022

7. Bureau of Economic Analysis, July 28, 2022

8. Bureau of Labor Statistics, July 8, 2022

9. CNBC.com, July 15, 2022

10. FederalReserve.gov, July 15, 2022

11. WSJ.com, July 19, 2022

12. CNBC.com, July 20, 2022

13. MarketWatch.com, July 26, 2022

14. CNBC.com, July 13, 2022

15. WSJ.com, July 27, 2022

16. CNBC.com, July 27, 2022

by Guy Woolley | Jul 11, 2022 | Finance

July 11, 2022

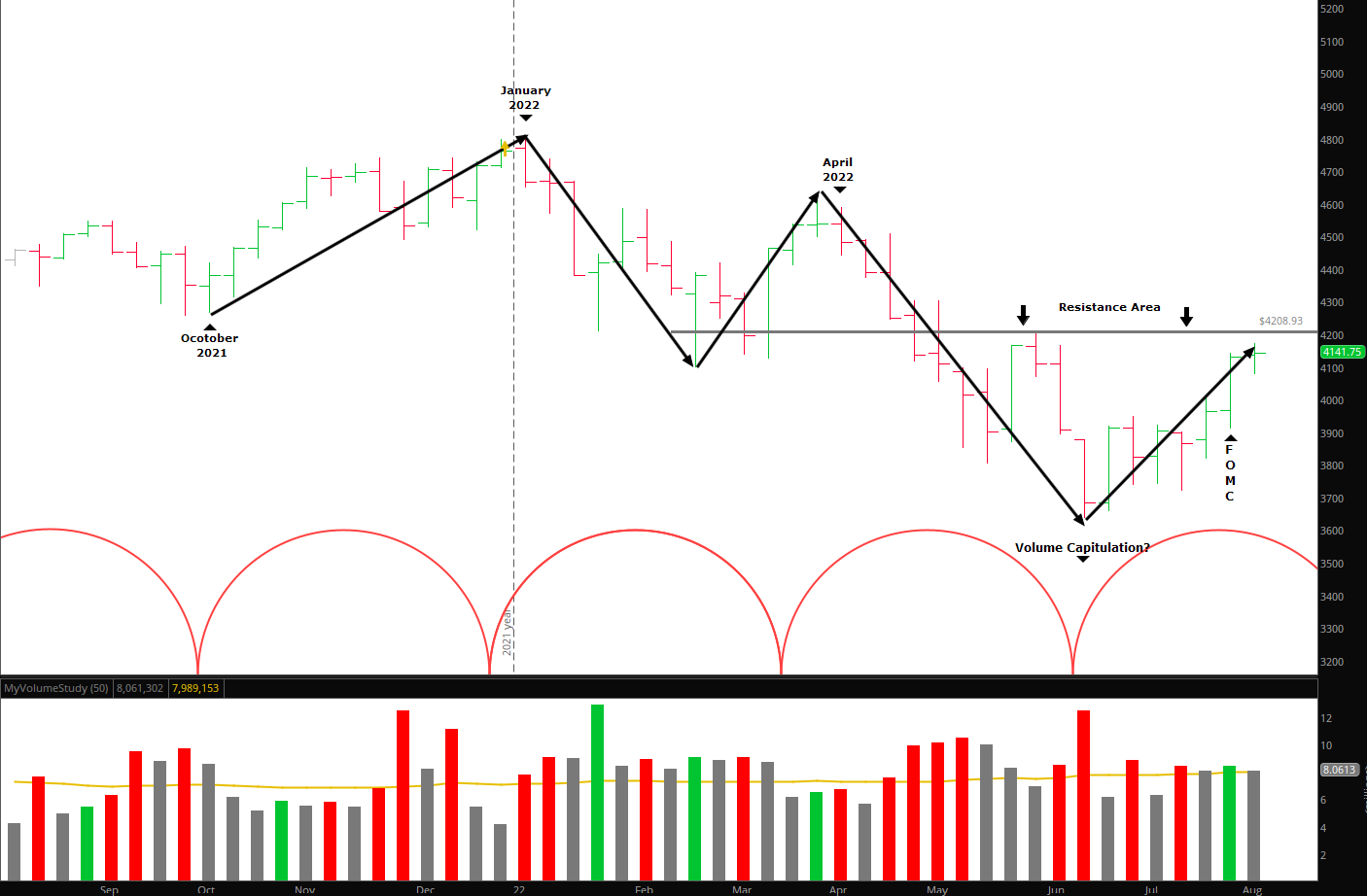

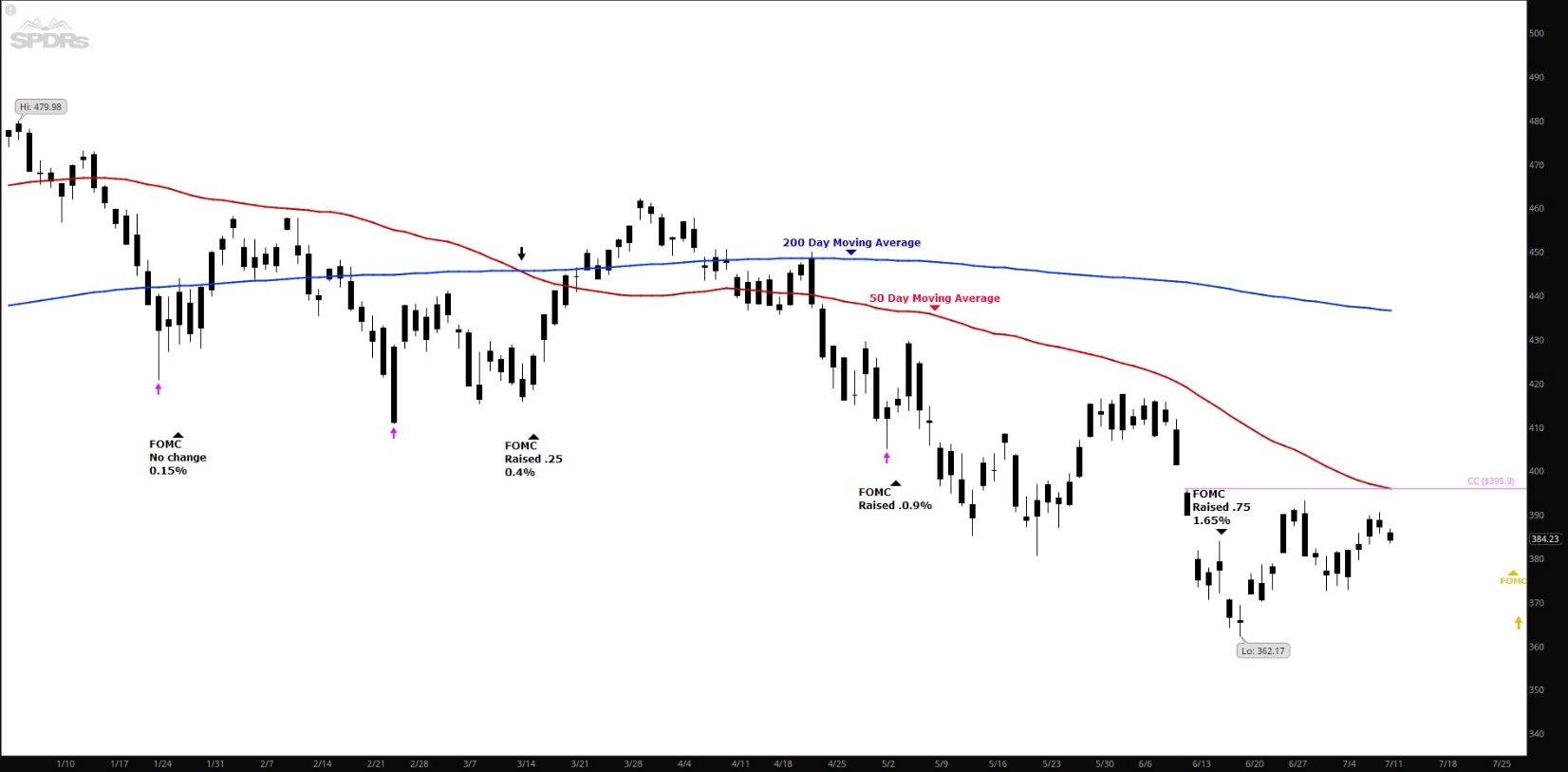

The Chart above is the S&P 500 exchange-traded fund, “SPY” year-to-date. It is easy to see the downtrend the market has been in for the last 6 months. I have marked the four FOMC meetings that the Fed had this year. The next meeting announcement will be on July 27. The sentiment is for another rate hike of at least 1/2%. On Wednesday, July 13 the Bureau of Labor Statistics will be releasing the CPI report which measures the change in the prices of goods and services purchased by consumers, and on Thursday they will be releasing the PPI report which measures the price of finished goods and services sold by producers. These are numbers the Fed uses to gauge the signs of inflation. If rate hikes can slow down the economy and overall spending, we will see the inflation numbers also decreasing, but this may take quite some time before the market recovers and shows some meaningful strength.

Last month I mentioned and am still looking for “capitulation.” Capitulation means surrender. In financial markets capitulation happens when a significant proportion of investors succumb to fear and sell over a short period of time, causing the price of a market to drop sharply amid high trading volume. This usually puts the market in a very oversold position and encourages long-term money managers to step back in.

Market volatility may not ease until the Fed gives investors and consumers a better indication of how high and how long they are planning to raise the interest rates.

The VIX Index closed Friday at 24.64, not much lower than the close on 6/1 at 25.69. A high VIX is normally bearish for the markets. I prefer the VIX below 20 and a VIX below 15 is more bullish.

Percent of stocks above their 50-day and 200-day moving average: On 6/1 only 32% of stocks were above their 50-day moving average, today only 25% are above their 50-day moving average. Last month 30% of the stocks were above their 200-day moving average, today 20% are above their 200-day moving average. These very low numbers are signs of an oversold market. When 60% of stocks are above their 200-day moving average and the 50-day is rising and above the 200-day moving average, that is bullish. A sign of strength would be if the stocks above their 50-day moving average begin to rise higher, and even stronger when the 50DMA is above the 200DMA.

Federal Reserve: The next FOMC meeting announcement will be Wednesday, July 27th. At this time there is a 100% expectation that the Federal Reserve will raise rates 1/2 percent.

Employment Rate: Total nonfarm payroll employment rose by 372,000 in June, and the unemployment rate remained at 3.6 percent, the U.S. Bureau of Labor Statistics reported on July 8th. Notable job gains occurred in professional and business services, leisure and hospitality, and health care.

Inflation Rate: The next inflation update is scheduled for July 13. The annual inflation rate for the United States is 8.6% for the 12 months ended May 2022, the largest annual increase since December 1981 and after rising 8.3% previously, according to U.S. Labor Department data published June 10. The next inflation update is scheduled for release on July 13 at 8:30 a.m. ET. It will offer the rate of inflation over the 12 months ended in June 2022.

The 10-year Treasury index yield: The rate today is at 2.9%, the same rate it was on June 1 at 2.9%.

To view past Market Newsletters, go to www.freedomcapitalmanagement.com. On the home page you will see recent newsletters and for older newsletters go to the blog page tab at the top of the home page.

In this month’s recap: Stocks fell as growing recession talk prompted investors to manage risk in their portfolios.

Monthly Economic Update

Presented by Guy Woolley, July 2022

U.S. Markets

Stock prices were lower in June as recession talk prompted investors to manage risk in their portfolios.

The Dow Jones Industrial Average lost 6.71 percent, while the Standard & Poor’s 500 Index fell 8.39 percent. The tech-heavy Nasdaq Composite dropped 8.71 percent.1

Focus on Inflation

Markets grappled this month with an uncertain economic outlook. After a descent in the first half of June, markets were further rattled by the May inflation report which showed an 8.6 percent increase, year-over-year, in the Consumer Price Index (CPI). Led by a 34.6 percent increase in energy prices and a 10.1 percent rise in food prices, making this the highest rate of increase since December 1981.2

The unwelcome CPI number raised concerns that the Fed would need to become more aggressive with its rate hikes, making the prospect of a recession more likely.

Fed Raises Rates

Stocks briefly rallied after the Fed announced a hike in short-term interest rates of 75 basis points. All Fed members said they expected rates to rise to at least 3 percent by year-end, with half anticipating that rates may rise to 3.375 percent.3

Powell’s Commitment

On June 22, Fed Chair Powell told Congress that the Fed was committed to combating inflation. Stocks surged in the third week of the month on the premise that an economic slowdown may allow the Fed to be less aggressive with future rate hikes. But the enthusiasm faded in the final days of trading as choppy price action led to declines to close out the month.

Sector Scorecard

All industry sectors were lower in June, with declines in Communications Services (-9.82 percent), Consumer Discretionary (-11.04 percent), Consumer Staples (-3.08 percent), Energy (-17.91 percent), Financials (-11.14 percent), Health Care (-3.02 percent), Industrials (-7.77 percent), Materials (-14.41 percent), Real Estate (-7.64 percent), Technology (-9.48 percent) and Utilities (-5.65 percent).4

What Investors May Be Talking About in July

Earnings season begins in early July, providing investors with key insights into the health of American consumers. Companies will also communicate how they are navigating an increasingly challenging economic landscape.

Since the start of 2022, stocks have become less expensive on the basis of their price/earnings (P/E) ratios. When the stock market hit an all-time high on January 3, 2022, the forward P/E ratio for the S&P 500 index was 21.4. The 25-year average P/E sits at 16.5, for the period ended May 12, 2022. At the end of June 2022, the average forward P/E was 15.9.5,6

Each quarter, the degree to which the stock market responds to corporate earnings varies. But as investors grapple with a cloudy outlook, company reports over the next four to six weeks may serve as an important barometer for measuring the nation’s economic health and evaluating stock prices.

T I P O F T H E M O N T H

New parents can sometimes spend a little too much on cute and trendy stuff. Here’s a test: will the item improve the quality of care for your baby? If not, leave it at the store.

World Markets

Slowing economic activity and rising inflation dragged overseas markets lower, with the MSCI-EAFE Index sliding 8.07 percent last month.7

Major European markets were under pressure this month, as they faced increasing economic and geopolitical headwinds. Italy fell to -12.86 percent, while Germany dropped to -10.95 percent. Meanwhile, France dipped to -8.31 percent, as Spain decreased to -7.63 and the U.K. to -5.77 percent.8

Pacific Rim markets were lower with the exception of Hong Kong, which rose 2.08 as China emerged from its COVID lockdown. Korea fell -14.17 percent, Australia -9.31 percent and Japan -4.93 percent.9

Indicators

Gross Domestic Product: The final estimate of first quarter GDP growth was revised lower to -1.6 percent.10

Employment: Employers added 390,000 new jobs in May, which represented a slower pace than previous months despite a healthier number than expected. The unemployment rate remained unchanged at 3.6 percent, while wage growth moderated from 5.5 percent in April to 5.2 percent in May.11

Retail Sales: Retail sales fell 0.3 percent in May, perhaps reflecting the squeeze from higher costs and interest rates. Excluding gasoline sales, retail sales fell 0.7 percent.12

Industrial Production: Output at the nation’s factories, mines, and utilities rose 0.2 percent, the fifth consecutive monthly increase.13

Housing: Housing starts fell to their lowest level in over a year, declining 14.4 percent in May. Single-family homes dropped 9.2 percent, while multiple family housing sagged 26.8 percent.14

Sales of existing homes fell 3.4 percent in comparison to April and were 8.6 percent lower than a year ago. It was the weakest reading since June 2020.15

New home sales posted their first gain this year, rising 10.7 percent in May.16

Consumer Price Index: Consumer prices rose 8.6 percent from May 2021 levels, the highest rate since December 1981. Energy (+34.6 percent) and food (+10.1 percent) prices led the year-over-year increase in the Consumer Price Index (CPI). On a month-to-month basis, the CPI rose well above the consensus estimate of 0.7 percent to a full 1 percent.17

Durable Goods Orders: New orders for long lasting goods rose 0.7 percent in May, making it the seventh out of the last eight months that orders have increased.18

Q U O T E O F T H E M O N T H

“Golf is deceptively simple and endlessly complicated; it satisfies the soul and frustrates the intellect. It is at the same time rewarding and maddening—and it is without a doubt the greatest game mankind has ever invented.”

ARNOLD PALMER

The Fed

The Federal Reserve announced a 0.75 percent hike in the federal funds rate. It was the biggest rate increase since 1994.19

The announcement was made following the June 14–15 meeting of the Federal Open Market Committee (FOMC). The FOMC also indicated new rate projections, showing that all members expect rates to rise to at least 3.0 percent by year-end and half the members expecting rates to rise to 3.375 percent.

The 75-basis-point rate increase was higher than earlier Fed guidance of a 50-basis-point increase and a response to recent inflation data and rising inflationary expectations.19

| MARKET INDEX |

Y-T-D CHANGE |

June 2022 |

| DJIA |

-15.31% |

-6.71% |

| NASDAQ |

-29.51% |

-8.71% |

| S&P 500 |

-20.58% |

-8.39% |

|

|

|

| BOND YIELD |

Y-T-D |

June 2022 |

| 10 YR TREASURY |

1.46% |

2.97% |

Sources: Yahoo Finance, June 30, 2022.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

T H E M O N T H L Y R I D D L E

Tim says he heard that you can find $200 stuffed between pages 147 and 148 of a romance novel at the library. What detail convinces you that he is wrong?

LAST MONTH’S RIDDLE: It has a back and four legs, yet it can’t run. It has two arms, but no hands. You don’t keep it as a pet, but you likely have one in your home right now. What is it?

ANSWER: A couch.

Guy Woolley may be reached at 415-236-5364 or [email protected]

www.freedomcapitalmanagement.com

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

«RepresentativeEmailDisclosure»

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The FTSEurofirst 300 Index comprises the 300 largest companies ranked by market capitalization in the FTSE Developed Europe Index. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. Established in January 1980, the All Ordinaries is the oldest index of shares in Australia. It is made up of the share prices for 500 of the largest companies listed on the Australian Securities Exchange. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The FTSE TWSE Taiwan 50 Index is a capitalization-weighted index of stocks comprising 50 companies listed on the Taiwan Stock Exchange developed by Taiwan Stock Exchange in collaboration with FTSE. The MSCI World Index is a free-float weighted equity index that includes developed world markets and does not include emerging markets. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The U.S. Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting, or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1. WSJ.com, June 30, 2022

2. CNBC.com, June 10, 2022

3. WSJ.com, June 15, 2022

4. Sector.SPDR.com, June 2022

5. Insight.Factset.com, May 16, 2022

6. am.JPMorgan.com, June 30, 2022

7. MSCI.com, June 30, 2022

8. MSCI.com, June 30, 2022

9. MSCI.com, June 30, 2022

10. BEA.gov, June 29, 2022

11. WSJ.com, June 3, 2022

12. WSJ.com, June 15, 2022

13. MarketWatch.com, June 17, 2022

14. MarketWatch.com, June 16, 2022

15. CNBC.com, June 21, 2022

16. Bloomberg.com, June 24, 2022

17. CNBC.com, June 10, 2022

18. Census.gov, June 27, 2022

19. WSJ.com, June 15, 2022

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()