4/5/2020

I hope everyone is healthy and staying out of harm’s way. To begin I am going to examine what the technical traders are discussing regarding the Markets. Specifically, the S&P 500 index.

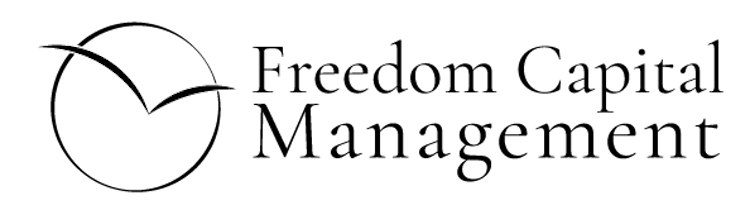

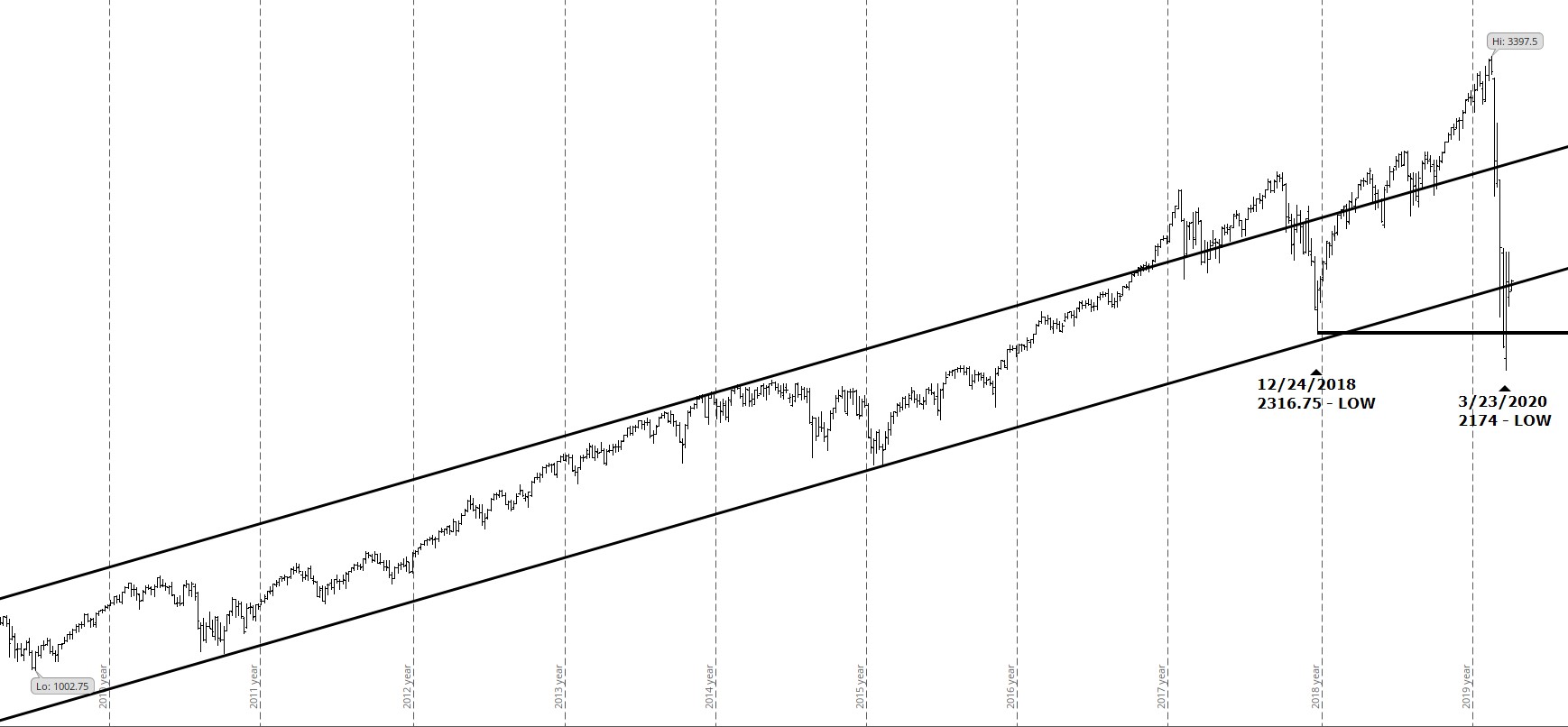

The Chart above is of the E-mini S&P 500 Index on a 10-year weekly chart. You can see for almost 9 years the S&P 500 traded in an upward channel in a very orderly way. On the right side of the chart you can see the extremely quick drop when as the Coronavirus made the news I have marked the low that was made on 12/24/2018 and the lower low, to the right, that the S&P 500 made on 3/23/2020, almost 1-1/2 years later . The markets high was 3397.50 on 2/20/2020 and the recent low was at 2174 on 3/23/2020. That unprecedented drop only took 22 days. The chart below is a daily chart of the E-Mini S&P 500 index that starts at the beginning of this year.

Since the low on 3/23/2020 within the last 8 days the market has been trading in a horizontal channel. Also notice the light gray line is the mark of the 10-year channel which is shown of the first chart. The market is back in the channel. Technical traders are watching if the market breaks above or below the horizontal channel it is in now. They will also be watching if volume increases, as volume over the last few days has calmed down. Everybody is hoping to see the Coronavirus cases start to decline, but the medical predictions and projections are changing every day. There will be opportunities at some point but right now we must be cautious.

The VIX Index has traded as high as 85.47, closed Friday at 46.80. It has begun to fall but is still at a very high level. A High VIX is an indication that market prices could swing widely and rapidly.

Percent of stocks above their 50 day and 200 day moving average. Only 5.9% of stocks are above their 50-day moving average and only 8.7% of the stocks are above their 200-day moving average. These are very bearish numbers. Will be looking for a significant increase in stocks to trade above their 50-day moving average.

Federal Reserve: After two unscheduled rate cuts the next FOMC meeting is on April 29th.

Unemployment Rate: The number of unemployed persons rose to 7.1 million in March as reported by the Bureau of Labor Statistics.

Inflation Rate: The core inflation rate rose to 2.5% as higher food, shelter and medical care rise as reported on March 11 by the Labor Department.

Here is what is needed: The VIX to continue to fall, the percent of stocks above their 50-day moving average to rise, and for the unemployed to be able to get back to work.

In this month’s recap: The CARES Act moves to assist Americans quarantined by COVID-19, providing relief with a $2T stimulus package; markets worldwide react to coronavirus-related volatility.

Monthly Economic Update

![]()

Presented by Guy Woolley, April 2020

THE MONTH IN BRIEF

The Coronavirus Aid, Relief, and Economic Security (CARES) Act has been signed into law, bringing relief to millions of Americans, most of whom are expected to be quarantined for at least another month. The White House has asked Americans to continue “socially distancing” during the month of April. Volatility continued in International markets, even as the COVID-19 (novel coronavirus) reached the United States. The Standard and Poor’s 500 (S&P 500) Index was down 12.51% for March.1

![]()

DOMESTIC ECONOMIC HEALTH

At the end of March, the CARES Act was signed into law, releasing $2 trillion in relief to millions of Americans and U.S. businesses. This includes $1,200 checks to American taxpayers ($2,400 to married couples) and four months of additional $600 payments to those claiming unemployment.2,3

February’s unemployment rate rose a point to 5.6% (U-6 Unemployment rose to 7%), prior to the St. Louis Fed’s declaration that unemployment could jump to 32.1%, post-coronavirus. The 47 million out-of-work Americans would be the highest number seen since 1948. Michigan consumer sentiment numbers dropped to 89.1 for March, while February’s consumer spending stayed at 0.2%. February retail sales dropped to -0.5% from the previous month’s 0.6%. The ISM Purchasing Managers Index (PMI) dropped to 50.1 for February with new orders sinking to 45.9. The ISM Non-Manufacturing PMI rose to 57.3.4,5,6

GLOBAL ECONOMIC HEALTH

China, where the first widespread outbreak of COVID-19 was reported, has reported a considerable drop in cases (though, it is difficult to verify their numbers). However, the loss of workers due to illness and the changes in demand worldwide may have a long-term effect on China’s gross domestic product (GDP). The overall drop of 3.7% in GDP, crossed with an upswing in China’s manufacturing PMI to a score of 52, indicate a country that has come back to work.7,8,9

Europe and the United Kingdom have also been hit heavily by COVID-19, with Italy and Spain seeing a large number of cases. Aggressive actions to subsidize employment in Europe are projected to stem unemployment claims to some degree. Meanwhile, inflation in the 19-country euro area has dropped to 0.7%.10,11

WORLD MARKETS

There were several markets sinking in March, including the U.K.’s FTSE 100 (-13.81%), the German Dax (-16.44%), the French CAC 40 (-17.21%), Japan’s Nikkei 225 (-10.53%), Australia’s All-Ordinaries (-21.51), Brazil’s Bovespa (-29.90), Mexico’s Bolsa (-16.38%), Hong Kong’s Hang Seng (-9.67), China’s Shanghai Composite (-4.51), Malaysia’s KLCI (-8.89), South Korea’s Kospi Composite (-11.69), and Russia’s RTS (-21.95).12,13

The MSCI EAFE Index (which measures performance across developed stock markets outside North America) took a 14.77% fall.14

COMMODITIES MARKETS

Energy commodities fell in March, including light crude (-55.17%), heating oil (-33.10%), natural gas (-3.12%), and unleaded gas (-59.45%). The drop in oil prices was attributed to Saudi Arabia and Russia, who show no signs of compromising in their standoff over oil supply.15

Meanwhile, other commodities stepped into negative territory in March, such as corn (-6.75%), cocoa (-18.88%), cotton (-16.65%), and sugar (-25.80%). The exceptions for March were soybeans (+0.11%), wheat (+7.38%), and coffee (+7.41%).15

Metals also had a difficult month, with March numbers diminishing for gold (-0.74%), silver (-14.75%), platinum (-17.13%), and copper (-12.96%). The U.S. Dollar Index closed at 98.95, up 1.62%.15,16

REAL ESTATE

Freddy Mac’s Primary Mortgage Market Survey for March 26 revealed the mean interest rate on a 30-year home loan as 3.5%, up 0.05% since the end of February. The 15-year home loan sank 0.03% to 2.92%.17

Existing home sales rose to 6.5% for February, with 5.77 million homes available. New home sales fell back 4.4% for February, with 765,000 houses on the market. Housing starts also pulled back 1.5%. Building permits stepped back 5.5%.4

![]()

T I P O F T H E M O N T H

Anyone who starts a business needs an operational strategy. A good one includes metrics, a day-to-day plan detailing who will do what, and an assessment of external and internal risks.

![]()

LOOKING BACK, LOOKING FORWARD

March saw the end of the worst quarter for stocks in U.S. history. The Dow Jones Industrial Average (DJIA) closed at 21,917.16. The Standard and Poor’s 500 (S&P 500) ended the month at 2,584.59, while the NASDAQ Composite Index closed at 7,700.10.18

|

MARKET INDEX |

Y-T-D CHANGE |

1-MO CHANGE |

2019 |

|

DJIA |

-23.20 |

-13.72 |

+22.34 |

|

NASDAQ |

-14.18 |

-10.12 |

+35.23 |

|

S&P 500 |

-20.00 |

-12.51 |

+28.88 |

|

3/31 RATE |

1 MO AGO |

1 YR AGO |

|

|

10-YR TREASURY |

0.70 |

1.13 |

2.41 |

Sources: Bloomberg.com, Barchart.com, treasury.gov – 00/00/00

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year Treasury real yield = projected return on investment, expressed as a percentage, on the U.S. government’s 10-year bond.

Amid so much uncertainty about the duration and impact of the COVID-19 coronavirus, it’s difficult to say how much volatility might be ahead. The arrival of CARES Act checks and other stimulus measures should be a welcome relief to households and businesses. While it’s far too early to understand the full economic impact of what’s to come, the news that this ordeal has passed will be very welcome.

![]()

Q U O T E O F T H E M O N T H

“Adversity is the first path to truth.”

Lord BYRON

![]()

UPCOMING RELEASES

Here are some of the economic news items for investors to consider in April: the March Institute for Supply Management Non-Manufacturing Index (4/3), March’s Consumer Price Index (4/10), March’s Producer Price Index (4/9), the initial April Consumer Sentiment Index from the University of Michigan (4/9), March retail sales (4/15), March housing construction activity (4/16), March existing home sales (4/21), March new home sales (4/23), March durable goods orders (4/24), March personal spending and income and the final April University of Michigan Consumer Sentiment Index (4/24), the estimate of first-quarter gross domestic product from the Bureau of Economic Analysis (4/29), and then the Conference Board’s March Consumer Confidence Index and the latest S&P/Case-Shiller Home Price Index (4/28). NOTE: Some releases may be delayed or rescheduled in the wake of the COVID-19 epidemic.

![]()

T H E M O N T H L Y R I D D L E

While most English words can be pluralized by adding the letter S on the end, there is one word that can be pluralized just by the addition of the letter C. What is it?

LAST MONTH’S RIDDLE: What gets broken without being held?

ANSWER: A promise.

![]()

Guy Woolley may be reached at 415-236-5364

www.freedomcapitalmanagement.com

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

![]()

Disclosures:

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The FTSE Bursa Malaysia KLCI, also known as the FBM KLCI, is a capitalization-weighted stock market index, composed of the 30 largest companies on the Bursa Malaysia by market capitalization. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The NIFTY 50 (National Index Fifty) is the broad-based stock market index for the Indian equity market. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. Established in January 1980, the All Ordinaries is the oldest index of shares in Australia. It is made up of the share prices for 500 of the largest companies listed on the Australian Securities Exchange. The Korea Composite Stock Price Index, or KOSPI, is the representative stock market index of South Korea, like the S&P 500 in the United States. The Nikkei-225 Stock Average is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. The MSCI EAFE Index is an equity index which captures large and midcap representation across 21 developed markets countries around the world, excluding the U.S. and Canada. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The Bovespa Index, best known as Ibovespa, is the benchmark index of about 60 stocks that are traded on the B3 (Brasil Bolsa Balcão). The DAX is a blue-chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The RTS Index is a free-float capitalization-weighted index of 50 Russian stocks traded on the Moscow Exchange, calculated in U.S. dollars. The U.S. Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – CNN.com, March 31, 2020.

2 – CNBC.com, March 30, 2020.

3 – Forbes.com, March 29, 2020.

4 – Investing.com, March 31, 2020.

5 – USA Today, March 31, 2020.

6 – MarketWatch, March 31, 2020.

7 – CNBC.com, April 1, 2020.

8 – Nikkei Asian Review, March 31, 2020.

9 – Forbes.com, March 31, 2020.

10 – CNBC.com, March 30, 2020.

11 – Eurostat, March 31, 2020.

12 – New York Times, March 31, 2020.

13 – Barchart.com, March 31, 2020.

14 – MarketWatch.com, March 31, 2020.

15 – CNN.com, March 31, 2020.

16 – MarketWatch.com, March 31, 2020.

17 – Freddie Mac, March 31, 2020.

18 – Bloomberg.com, March 31, 2020.