by | Jul 16, 2020 | Finance

Date: July 11, 2020

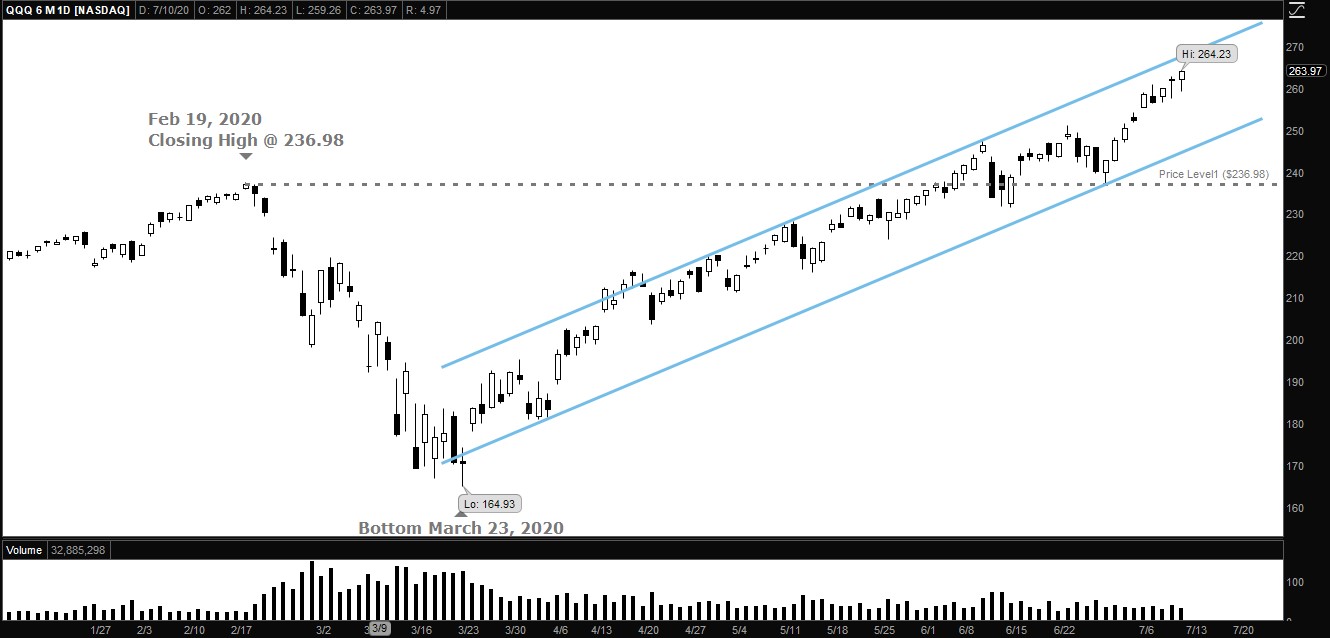

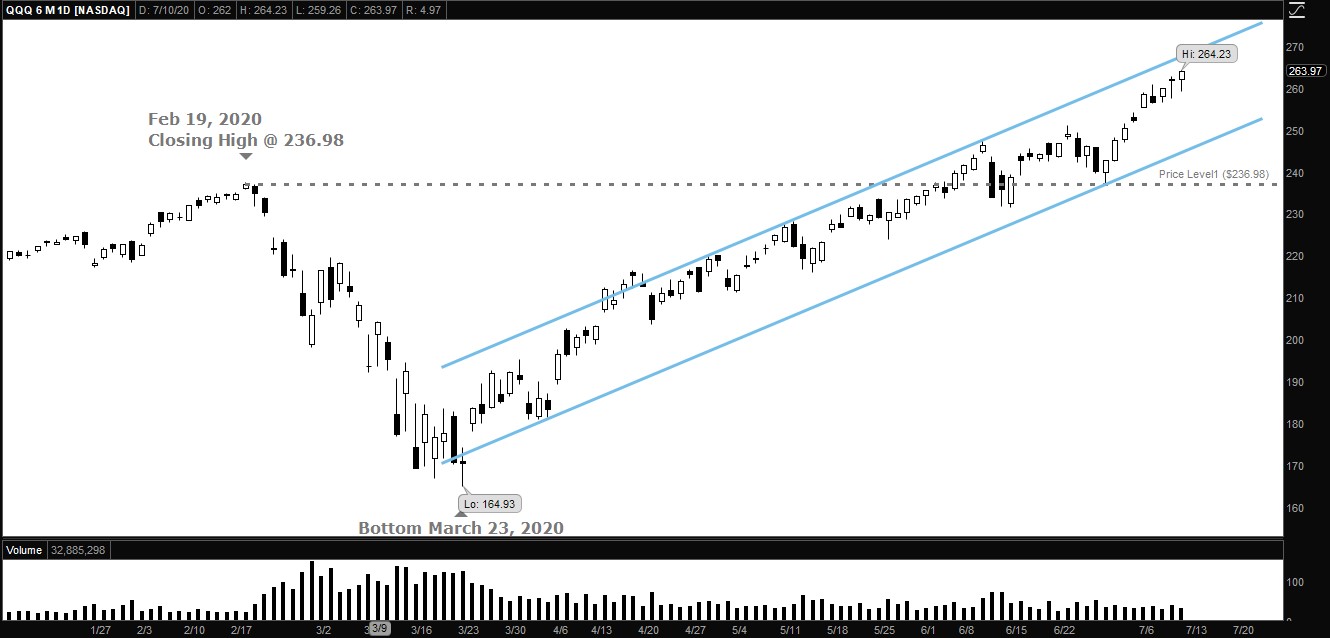

The chart below is the Nasdaq 100 Exchange Traded Fund (QQQ) which continues to lead the S&P-500 and Dow Jones Industrial Indexes. The QQQ’s are over 10% over the February 19, 2020 high, while the S&P 500 and the Dow Jones Industrial averages are over 6% below the February 19, 2020 highs. The Nasdaq 100 consists of the technology and biotechnology stocks that seem to be showing the most strength in this “Coronavirus rally.” Think of it, the technology stocks are providing solutions for the work at home and the shop from home needs. The Biotechnology stocks are racing to conquer the coronavirus issues. One should take notice the blue channel bands that the Nasdaq 100 is in and how it tends to pull back when it hits the top of the channel. That top blue resistance band is something we will be watching in the coming days.

The VIX Index closed at 27.29. That is the lowest it has been in 20 days. A declining VIX is bullish for the markets. A VIX below 15 is even more bullish.

Percent of stocks above their 50 day and 200 day moving average. 62% of stocks are above their 50-day moving average and only 41% of the stocks are above their 200-day moving average, which is lower than last month. When 60% of stocks are above their 200-day moving average, that is very bullish.

Federal Reserve: The next FOMC meeting is on July 28 & 29, 2020.

Unemployment Rate: Total nonfarm payroll employment rose by 4.8 million in June, and the unemployment rate declined to 11.1 percent, the U.S. Bureau of Labor Statistics reported July 2, 2020.

Inflation Rate: The annual inflation rate for the United States is 0.1% for the 12 months ended May 2020 as compared to 0.3% previously, according to U.S. Labor Department data published on June 10, 2020.

Overall, these are cautious indications for the markets.

In this month’s recap: stocks notched a solid gain, overcoming the rise of reported COVID-19 cases and plans of a slowdown in economic re-openings.

Monthly Economic Update

Presented by Guy Woolley, July 2020

U.S. Markets

Stock prices climbed higher in June, as investors looked beyond an increase in COVID-19 cases as well as reports that several states planned to slow the pace of their economic re-opening.

The Dow Jones Industrial Average gained 1.69%, while the Standard & Poor’s 500 Index tacked on 1.84%. The Nasdaq Composite, already up 6.75% in May, rose another 5.99%.1

Momentum Lost

Stocks opened the month higher, but the momentum quickly stalled, as states struggled to re-open their economies while facing an increase in COVID-19 cases. Investor sentiment was further dampened by a subdued forecast of economic recovery issued by the Federal Reserve.

Focus Shifted

But the market turned and rallied on a series of upbeat news announcements. First, by the Fed, which said that it would extend its bond-buying program to include the debt of individual companies. Second, a strong retail sales report buoyed spirits. And finally, the news of an effective COVID-19 treatment for critically ill patients strengthened investor sentiment.

Bump Up in COVID-19

Market direction reversed late in the month, due to an increase in COVID-19 cases in Florida, Texas, and California, which prompted some states to roll back their re-opening plans.

However, stocks still closed out the month strong, posting back-to-back gains to cement a solid showing.

Sector Scorecard

Industry sectors were mixed in June, with gains in Consumer Discretionary (+1.54%), Industrials (+0.95%), Materials (+0.18%), and Technology (+4.78%), while losses were posted by Communication Services (-1.07%), Consumer Staples (-1.72%), Energy (-4.54%), Financials (-2.48%), Health Care (-4.49%), Real Estate (-0.98%), and Utilities (-5.81%).2

What Investors May Be Talking About in July

Assessing the economy has become increasingly difficult due to the uncertainties caused by the pandemic.

For example, May’s employment report from the Bureau of Labor Statistics showed that the economy added 2.5 million new jobs. Wall Street economists were stunned by the news, having forecast a drop of 8.3 million.3

T I P O F T H E M O N T H

Take a second look at monthly payments you may have contracted years ago (cell phone usage, for example). Plan prices may have dropped. Are you overpaying?

Rise in Real-Time Data

This has left many economists and analysts to look for more creative ways to gauge “real-time” economic activity. In an effort to expand their toolset beyond traditional government reporting, forecasters are now mining a robust vein of real-time data, such as satellite imaging, to count cars parked at retail locations.

They also are looking at data, generated by Google and Apple, to determine traffic, pedestrian volumes, and the number of people taking public transportation. Restaurant apps are getting used too. They can help show whether people are returning to social settings.

Traditional economic indicators remain vital, but expect a growing focus on newer, “big data” tools that give critical real-time snapshots.

World Markets

Economic re-opening and supportive central bank policies propelled markets overseas, as the MSCI-EAFE Index gained 2.92%.4

European markets responded to a general easing of economic lockdown and fresh central bank support. Germany rose 6.25%, while France picked up 5.12%. The U.K. lagged, gaining only 2.16%.5

Pacific Rim stocks were mostly higher. Japan tacked on 1.88%, while Australia climbed 1.35%.6

Indicators

Gross Domestic Product: The final reading of GDP growth for the first quarter was unchanged, at -5.0%.7

Employment: The unemployment rate dropped to 13.3%, as employers added 2.5 million new jobs in May. Many of the sectors hit hardest by employment cuts, such as the travel, hospitality, and retail industries, led the rebound in hiring.8

Retail Sales: Retail sales leaped 17.7% in May. Clothing and furniture stores led the group.9

Industrial Production: Industrial production climbed 1.4%; though, manufacturing output managed a stronger increase of 3.8%.10

Housing: Housing starts increased 4.3% in May; though, permits for future home construction rose 14.4%. The increase in permits indicates that home building may be emerging from its COVID-19-related contraction.11

Existing home sales dropped 9.7% in May.12

Sales of new homes rose 16.6%, which was above consensus estimates.13

Consumer Price Index: For the second straight month, consumer prices fell, dipping 0.1% in May. Core inflation, which excludes the more volatile food and energy components, also retreated by 0.1%.14

Durable Goods Orders: Orders for long-lasting goods jumped 15.8%, well above the consensus estimate of 10.3%.15

Q U O T E O F T H E M O N T H

“Only those who will risk going too far can possibly find out how far one can go.”

T.S. Eliot

The Fed

Following its Federal Open Market Committee two-day meeting in June, the Federal Reserve said that it planned to keep its federal funds rate near zero.

Fed Chair Jerome Powell confirmed that the Fed would maintain its monthly purchases of Treasury bonds and mortgage-backed securities.

The Fed also issued its forecasts for 2020 to 2022. It anticipates the federal funds rate remaining at zero, with inflation of 0.8% for 2020, 1.6% in 2021, and 1.7% in 2022.

Fed officials said that they expect the GDP to fall by 6.5% this year, but increase 5% in 2021 and 3.5% in 2022. Officials also expect unemployment to steadily decline over the next 2½ to 5½ years.16

|

MARKET INDEX

|

Y-T-D CHANGE

|

June 2020

|

|

DJIA

|

-9.55

|

1.69%

|

|

Nasdaq

|

12.11

|

5.99%

|

|

S&P 500

|

-4.04

|

1.84%

|

| |

|

|

|

BOND YIELD

|

Y-T-D

|

June 2020

|

|

10 YR TREASURY

|

-1.27%

|

0.65%

|

Sources: Yahoo Finance, June 30, 2020

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

T H E M O N T H L Y R I D D L E

Haretown and Tortoiseville are 44 miles apart. A hare travels at 8 miles per hour from Haretown to Tortoiseville, while a tortoise travels at 3 miles per hour from Tortoiseville to Haretown. If both set out at the same time, how many miles will the hare have to travel before meeting the tortoise en route?

LAST MONTH’S RIDDLE: Here’s a food riddle. Someone strips away the outside of this food, leaving you free to boil, cook, or grill the inside. (So, what was the “inside” is now an uncovered outside.) You eat the new outside, and throw away the inside of that. What kind of food are you eating?

ANSWER: Corn on the cob.

Guy Woolley may be reached at 415-236-5364 or [email protected]

www.freedomcapitalmanagement.com

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

«RepresentativeEmailDisclosure»

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The Nasdaq Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The FTSEurofirst 300 Index comprises the 300 largest companies ranked by market capitalisation in the FTSE Developed Europe Index. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. Established in January 1980, the All Ordinaries is the oldest index of shares in Australia. It is made up of the share prices for 500 of the largest companies listed on the Australian Securities Exchange. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The FTSE TWSE Taiwan 50 Index is a capitalization-weighted index of stocks comprises 50 companies listed on the Taiwan Stock Exchange developed by Taiwan Stock Exchange in collaboration with FTSE. The MSCI World Index is a free-float weighted equity index that includes developed world markets and does not include emerging markets. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The U.S. Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1. The Wall Street Journal, June 30, 2020

2. FactSet Research, June 30, 2020

3. The WashingtonPost.com, June 5, 2020

4. MSCI.com, June 30, 2020

5. MSCI.com, June 30, 2020

6. MSCI.com, June 30, 2020

7. CNBC.com, June 25, 2020

8. The Wall Street Journal, June 6, 2020

9. The Wall Street Journal, June 16, 2020

10. MarketWatch.com, June 16, 2020

11. CNBC.com, June 17, 2020

12. CNBC.com, June 22, 2020

13. Reuters.com, June 23, 2020

14. The Wall Street Journal, June 6, 2020

15. MarketWatch.com, June 25, 2020

16. CNBC.com, June 10, 2020

by | Jun 9, 2020 | Finance

June 6, 2020

I will start with – Retirement Information

What is the SECURE Act?

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed into law December 2019 and includes many reforms expanding access to workplace retirement plans for millions of full-and part-time workers, particularly small business employees. It also increases the age for required minimum distributions (RMDs) leaving more time for individuals to reach their savings goals.

When will the changes become effective?

Many of these changes are effective as of January 1, 2020.

Required Minimum Distribution (RMD) Impacts:

The law increases the age at which an individual must begin taking required minimum distributions (RMDs) from 70½ to 72. This will allow Americans to continue their retirement savings for an extended period of time.

• This change applies to individuals who will attain 70½ on or after January 1, 2020.

• If you turned 70½ in 2019 you are still responsible for satisfying your RMD for 2019 and all future years.

Market Information

Friday’s jobs report shocked investors with the addition of 2.5 million jobs and a sharply lower-than-expected unemployment rate of 13.3%. It is a sign that we are going back to work. The Dow, S&P500 and Nasdaq surged by 3.2%, 2.6% and 2.1%, respectively. All three Major Indices notched their third consecutive weekly win for the first time since December 2019. The Dow Jones Industrial Index, as of Friday’s close, finally crossed above the 200-day moving average. Now the Dow, S&P 500, NASDAQ, S&P 400 and the S&P 600 are all above their 200-day moving averages. Another bullish indication this week is that the NASDAQ Composite had a “golden cross”. A golden cross occurs when the 50-day moving average crosses above the 200-day moving average.

In recent days, the most beaten down sectors such as Airlines, Hospitality, and Energy stocks have begun to bounce back. Rotation often signals the end of a rally as money flows out of the winners and into losers. The markets are continuing to show strength, the question is how long will this rally last?

The VIX Index – has traded as down to 24.52. The VIX is still above average but continuing to fall. The fact that it is lower than last month is a positive sign.

Percent of stocks above their 50 day and 200 day moving average – 97% of stocks are above their 50-day moving average. 56% of the stocks are above their 200-day moving average compared to only 26% last month. Seeing more stocks moving above their 50-day moving average and now with over 50% above their 200-day is encouraging. Market strength has continued.

Federal Reserve – The next FOMC meeting is on June 9, 2020.

Unemployment Rate – On June 5th the U.S. Bureau of Labor Statistics reported unemployment rate dropped to 13.3 percent.

Inflation Rate – The annual inflation rate for the United States is 0.3% for the 12 months ended April 2020 as compared to 1.5% previously, according to U.S. Labor Department data published on May 12, 2020.

Conclusion – VIX Index needs to continue to fall, the percent of stocks above their 200-day moving average needs to continue to rise, the unemployed workers need to continue to go back to work and the virus numbers need to continue to decline.

In this month’s recap: stocks rallied in May, sparked by a supportive Federal Reserve, stories of states re-opening, and reported progress on a COVID-19 vaccine.

Monthly Economic Update

Presented by Guy Woolley, June 2020

U.S. Markets

Stocks rallied in May, sparked by a supportive Federal Reserve, stories of states re-opening, and reported progress on a COVID-19 vaccine. The Dow Jones Industrial Average rose 4.2%, while the Standard & Poor’s 500 Index picked up 4.5%. The NASDAQ Composite led, gaining 6.7%.1

Shift in Focus

April’s positive momentum continued into May, as stocks registered healthy gains, and investors looked to future economic hopes rather than current woes. Further aiding stocks was a better-than-expected jobs report and firming oil prices. Many investors breathed a sigh of relief on the news that U.S. and Chinese negotiators were planning to meet, despite the rising tensions between the two nations.

Fed’s Commitment

Stocks rallied, as hopes for a COVID-19 vaccine rose, and the Federal Reserve restated its commitment to do whatever would be necessary to support an economic recovery. Following Memorial Day weekend, stocks surged, once again, due to rising optimism over economic re-opening, reported declines in new COVID-19 cases, and further news surrounding the development of a potential vaccine.

Sector Scorecard

The majority of industry sectors moved higher in May, with increases in Communication Services (+11.54%), Consumer Discretionary (+7.79%), Energy (+7.63% Financials (+4.23%), Health Care (+2.26%), Industrials (+5.93%), Materials (+6.33%), Real Estate (+2.29%), Technology (+9.69%), and Utilities (+0.14%). Consumer Staples experienced a small loss (-0.07%).2

What Investors May Be Talking About in June

In some sense, many investors believe a sustained and complete economic recovery may rest upon developing a vaccine for COVID-19.

Vaccine Watch

The World Health Organization reports that there are more than 100 vaccine candidates, with 10 currently participating in clinical trials.3 Over the next couple months, results from several of these trials may be released.4,5 Depending on the results, the trials could provide the markets with a sense of optimism. If they prove disappointing, investors may dread the prospect of a prolonged economic recovery. Either way, many investors are cautiously monitoring the situation for further developments.

T I P O F T H E M O N T H

Updating your will is as important as having one. If you drafted a will years ago, it may likely need some adjustments. Revisit your will often and keep it up to date.

World Markets

World markets posted solid gains on economic recovery hopes, with the MSCI-EAFE Index rising 5.15%.6 European markets moved higher, with gains in France, Germany, and the Netherlands. The U.K. slipped 0.88%.7 Pacific Rim stocks were mixed, with advances in Australia (+5.37%) and Japan (+8.34%). Hong Kong dropped 6.83% due to China-related tensions. The volatile Merval Index, which tracks the largest companies based in Argentina, jumped 48.04%.8

Indicators

Gross Domestic Product: The economy shrunk at a 5.0% annual rate, higher than the initial estimate of 4.8%.9

Employment: The unemployment rate leaped to 14.7%, as nonfarm payrolls fell by 20.5 million. The unemployment rate was the highest seen since the Great Depression.10

Retail Sales: Retail sales plunged by 16.4%, with every sector lower except for non-store retailers, which are predominately Internet-based merchants.11

Industrial Production: Industrial production fell 11.2%, the largest one-month drop in the index’s 100-plus-year history.12

Housing: Housing starts declined 30.2% to their lowest level seen since 2015.13

Existing home sales tumbled 17.8% in April, which was the largest one-month drop since July 2010. The supply of homes declined 19.7%. Tightening inventories led to a new record high in the median home sales price ($286,800).14 Sales of new homes rose 0.6%, a surprise increase amid a consensus forecast of a nearly 22% drop.15

Consumer Price Index: The price of consumer goods posted its largest monthly drop since 2008, falling 0.8% in April. Excluding the more volatile food and energy sectors, core inflation declined 0.4%, the largest monthly drop since 1957.16

Durable Goods Orders: Orders of long-lasting goods dropped 17.2%, with demand for transportation equipment falling an eye-catching 47.3%.17

Q U O T E O F T H E M O N T H

“The older I get, the smarter my father seems to get.”

Tim RUSSERT

The Fed

Minutes from the last Federal Open Market Committee meeting reaffirmed a commitment to maintaining a zero-interest rate policy until inflation reaches the Fed’s 2% target, and unemployment returns to its pre-COVID-19 level. The Committee also focused on how they expect to use upcoming meetings to communicate about future policy decisions. The minutes also reinforced recent comments that the Fed was not inclined to move toward negative rates.18

| MARKET INDEX |

Y-T-D CHANGE |

May 2020 |

| DJIA |

-11.06% |

4.26% |

| NASDAQ |

5.76% |

6.75% |

| S&P 500 |

-5.77% |

4.53% |

|

|

|

| BOND YIELD |

Y-T-D |

May 2020 |

| 10 YR TREASURY |

-1.27% |

0.65% |

Sources: Yahoo Finance, May 31, 2020

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

T H E M O N T H L Y R I D D L E

Here’s a food riddle. Someone strips away the outside of this food, leaving you free to boil, cook, or grill the inside. (So, what was the “inside” is now an uncovered outside.) You eat the new outside and throw away the inside of that. What food are you eating?

LAST MONTH’S RIDDLE: Its teeth are sharp, and its spine is straight. It is not innately vicious, it does not hunt, but to cut things up is definitely its fate. What is it?

ANSWER: A saw.

Guy Woolley may be reached at 415-236-5364 or [email protected]

www.freedomcapitalmanagement.com

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

Disclosure

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade The Hang Seng Index is a benchmark index for the blue-chip stocks traded on the Hong Kong stock exchange. The KOSPI is an index of all stocks traded on the Korean Stock Exchange. The Nikkei 225 is a stock market index for the Tokyo Stock Exchange. The SENSEX is a stock market index of 30 companies listed on Bombay Stock Exchange. The Jakarta Composite Index is an index of all stocks that are traded on the Indonesia Stock Exchange. The Bovespa Index tracks 50 stocks traded on the Sao Paulo Stock, Mercantile & Futures Exchange. The IPC index measure of companies listed on the Mexican Stock Exchange. The MERVAL tracks the performance of large companies based in Argentina. The ASX 200 index is an index of stocks listed on the Australian Securities Exchange The DAX is a market index consisting of the 30 German companies trading on the Frankfurt Stock Exchange. The CAC 40 is a benchmark for the 40 most significant companies on the French stock market index. The Dow Jones Russia Index measures the performance of leading Russian Global Depositary Receipts (GDRs) that trade on the London Stock Exchange. The FTSE 100 Index is an index of the 100 companies with the highest market capitalization listed on the London Stock Exchange. The U.S. Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – The Wall Street Journal, May 31, 2020

2 – FactSet Research, May 31, 2020

3 – Who.int, May 27, 2020

4 – CNBC.com, May 13, 2020

5 – NBCnews.com, May 8, 2020

6 – MSCI.com, May 31, 2020

7 – MSCI.com, May 31, 2020

8 – MSCI.com, May 31, 2020

9 – The Wall Street Journal, May 28, 2020

10 – The Wall Street Journal, May 8, 2020

11 – The Wall Street Journal, May 15, 2020

12 – The Wall Street Journal, May 15, 2020

13 – CNBC.com, May 19, 2020

14 – CNBC.com, May 21, 2020

15 – CNBC.com, May 26, 2020

16 – The Wall Street Journal, May 12, 2020

17 – CNBC.com, May 28, 2020

18 – The Wall Street Journal, May 20, 2020

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()